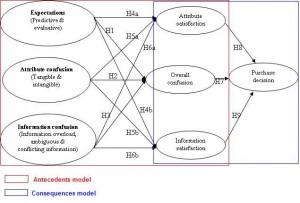

As stated in my earlier post ‘antecedents to consumer confusion‘, I shall focus on consequences of consumer confusion in this post. The earlier post focused on three important antecedents to consumer confusion namely; expectations, attribute confusion and information confusion in the context of financial services industry (i.e. banks, insurance. credit card, mortgage and other such investment firms).

In this post I will focus on three consequences of consumer confusion: (1) attribute satisfaction; (b) information satisfaction and (c) overall satisfaction.

Using quantitative methodology and established scales in the fields of psychology and consumer behaviour, we empirically tested the antecedents and consequences of consumer confusion. The findings suggest that expectations, attribute confusion and information confusion significantly affect overall confusion.

Furthermore, we also found that attribute confusion significantly affects attribute and information satisfaction however expectations do not. It was observed that information confusion significantly affected information satisfaction but did not affect attribute satisfaction. We also found the significant impact of overall confusion; attribute satisfaction and information satisfaction on purchase decision. Our results concur with the earlier research, that consumer confusion is a multi-dimensional phenomenon with significant impact on behavioural intentions. There are several theoretical and managerial implications from the above findings.

Increasing understanding of consumers and decreasing confusion is one of the major aims of any organization. Moreover, in markets like financial services, where many similarities of expectations, attributes and information exist within consumer minds, reduction in consumer confusion can become a source of competitive advantage. The framework for this study provides managers first hand idea of where and how consumer confusion is caused. This will assist managers in optimizing their organizational resources to manage the multi-faceted phenomenon of consumer confusion. Managers treating consumer confusion as a single tier construct may receive undesirable results. For example, just improving the product or service feature may reduce attribute confusion. However, poor communication and highly raised expectations may still elevate the overall confusion. Similarly, a good communication campaign with a less differentiated product or service may also elevate confusion in consumers’ minds.

The findings indicate that information confusion has an impact on information satisfaction and which in turn, has a strong influence on purchase decision. In the context of financial services industry, this issue merits consideration particularly where consumers are faced with wide ranging technical and complex information on the financial products which can create implications for purchase decision.

Managers can also use the study instrument in developing competitive intelligence by comparing the confusion caused by theirs as well as competitors’ products or services. This, we believe will yield rich managerial insights for firms and develop a better and unique campaign in comparison to competitors. The findings highlight the importance of prior expectations in causing confusion. This means that if the company communicates itself via advertisements and other means as a single entity and does not act like one in real-life, there are increased chances that it will make the consumers feel confused. The companies will have to simplify their offer to attract consumers. This is also reflected in the phenomena of attribute and information confusion. To avoid attribute and information confusion, managers will have to differentiate their product and simplify their communication to the consumers. While this might not be easy especially because of the legal requirements associated with FSI products, it is highly desirable.

The impact of confusion on satisfaction and purchase decision also needs further attention. It was observed that expectations did not affect the attribute or information satisfaction. This suggests that consumers do not see their expectations to be affecting their satisfaction, which is contradictory to earlier research in the area. Moreover, the significant impact of attribute confusion on attribute and information satisfaction indicates that the tangible and intangible aspects associated with the service have significant impact on consumer engagement with the service. This requires much close scrutiny by managers as there is little differentiation observed in FSIs with regard to attribute differentiation. If in further studies, this is found to be the case, then managers need serious reconsideration with regards to their branding, positioning and differentiation efforts. The significant impact of attribute confusion on attribute and information satisfaction concurs with earlier studies which focused on technology products. This suggests that the impact of confusion on satisfaction is not just industry specific. Therefore, managers could use our study dimensions to check the impact of confusion within other industries.

The findings also reveal the significant impact of information confusion on information satisfaction. However the impact is non-significant in the case of attribute satisfaction. Therefore, we suggest the use of attribute and information satisfaction as separate constructs in future studies rather than using overall satisfaction as a single construct. Furthermore, the study findings also highlight the complexity of relationship between the constructs. Managers should ensure that they treat these constructs as stand-alone rather than assuming a causal relationship.

Reference:

Paurav Shukla, Madhumita Banerjee, Phani Tej Adidam (2010), “Consumer Confusion in the Financial Services Industry: Antecedents and Consequences”, in Advances in Consumer Research Volume 37, eds. Margaret C. Campbell and Jeff Inman and Rik Pieters, Duluth, MN : Association for Consumer Research.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=e7b36cc8-3a53-44b2-94a7-808718cd6f88)